90-Day Money Reset After

A Layoff

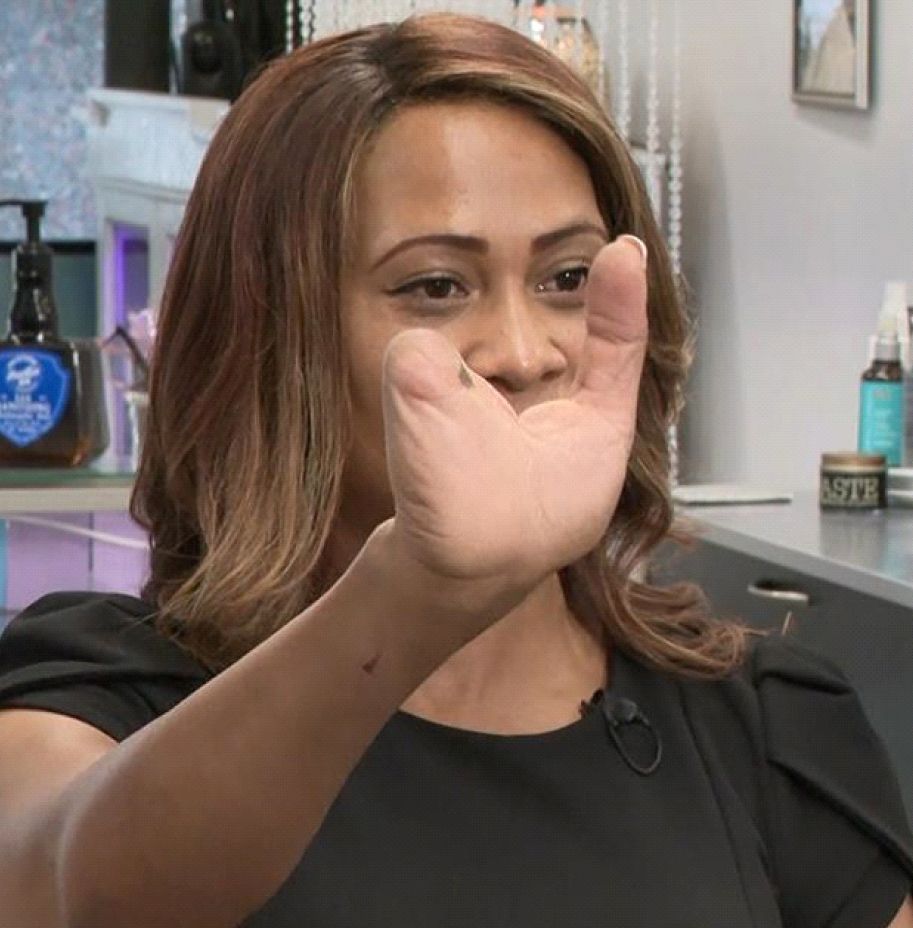

"Uchechi Kalu, CFP"

Losing a job can feel like the floor just dropped out from under you. For my friend, 11 years of government service ended with one phone call. Mortgage payments, daycare costs, and uncertainty hit all at once. But panic turned into a plan. This is the 90-day money reset strategy we built step by step to help her stay afloat and regain control.

Her parents are immigrants.

They always said a government job was safe.

Steady paycheck. Solid pension.

But that world doesn’t exist anymore.

She called me close to tears.

Mortgage due.

And don’t even get me started on daycare costs.

And then the fear hit: “I don’t even know where to start.”

So we built a plan.

THE FIRST 72 HOURS

⦁ List essential monthly expenses.

⦁ List cash on hand.

⦁ Create a barebones budget.

⦁ Calculate your cash runway (cash ÷ essentials).

⦁ File for unemployment.

⦁ Call all lenders (mortgage, student loans, credit cards) and ask about hardship programs, forbearance, or payment plans. Document every agreement.

⦁ Pause non-essential subscriptions.

DAYS 3–30

⦁ Pull your free credit reports.

⦁ Confirm health, life, and disability coverage during the furlough or layoff.

⦁ Understand cost of COBRA.

⦁ Explore temporary or part-time work if permitted; check agency or union rules.

⦁ Collect key documents (recent pay stubs, TSP statement, benefits summaries) in one folder.

⦁ Get written confirmation of hardship terms from all lenders.

DAYS 31–60

⦁ Shop for lower rates on auto, home, phone, and internet.

⦁ Ask for loyalty or low-income discounts.

⦁ Apply for SNAP or Medicaid if eligible.

⦁ Consider a 0% balance transfer if your credit is intact.

⦁ Apply to three jobs per week and reach out to five contacts per week to network intentionally.

DAYS 61–90

⦁ If you’re back to work: Restart your normal budget, catch up on deferred bills, and rebuild your emergency fund.

⦁ If you’re still laid off: Continue weekly job applications, networking targets, training or certification options. Note what’s working and do more of that.

⦁ If you’re separating permanently: Decide whether to keep or roll over your TSP after comparing fees, investment options, and access needs.

WHAT TO AVOID

⦁ Payday loans or high-fee cash advances.

⦁ Letting health coverage lapse.

⦁ Withdrawing retirement funds before exploring cheaper alternatives.

⦁ Missing payments without calling first and documenting hardship.

ABOVE ALL ELSE

⦁ Rest.

⦁ Feel the grief. In a capitalist society it’s never “just a job.”

⦁ Lean on community. Ask for help. Don’t go at this alone.

And if you’re looking for a Certified Financial Planner to help you get through it all, c

all me: https://lnkd.in/gHWS5JKD

About the Author

Uchechi Kalu, CFP®, is a Certified Financial Planner who helps individuals and families build financial stability through practical planning, intentional strategy, and community support. She specializes in guiding people through major life transitions with clarity and confidence.

Sparkman Articles